AdAccess IRS Tax Forms Complete, Edit or Print Tax Forms Instantly Download Or Email Schedule C & More Fillable Forms, Register and Subscribe Now! Form 1099C Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished toForm 1099C is used to report a canceled or forgiven debt of $600 or more The lender submits the form to the IRS and to the borrower, who uses the form to report the canceled debt on his

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

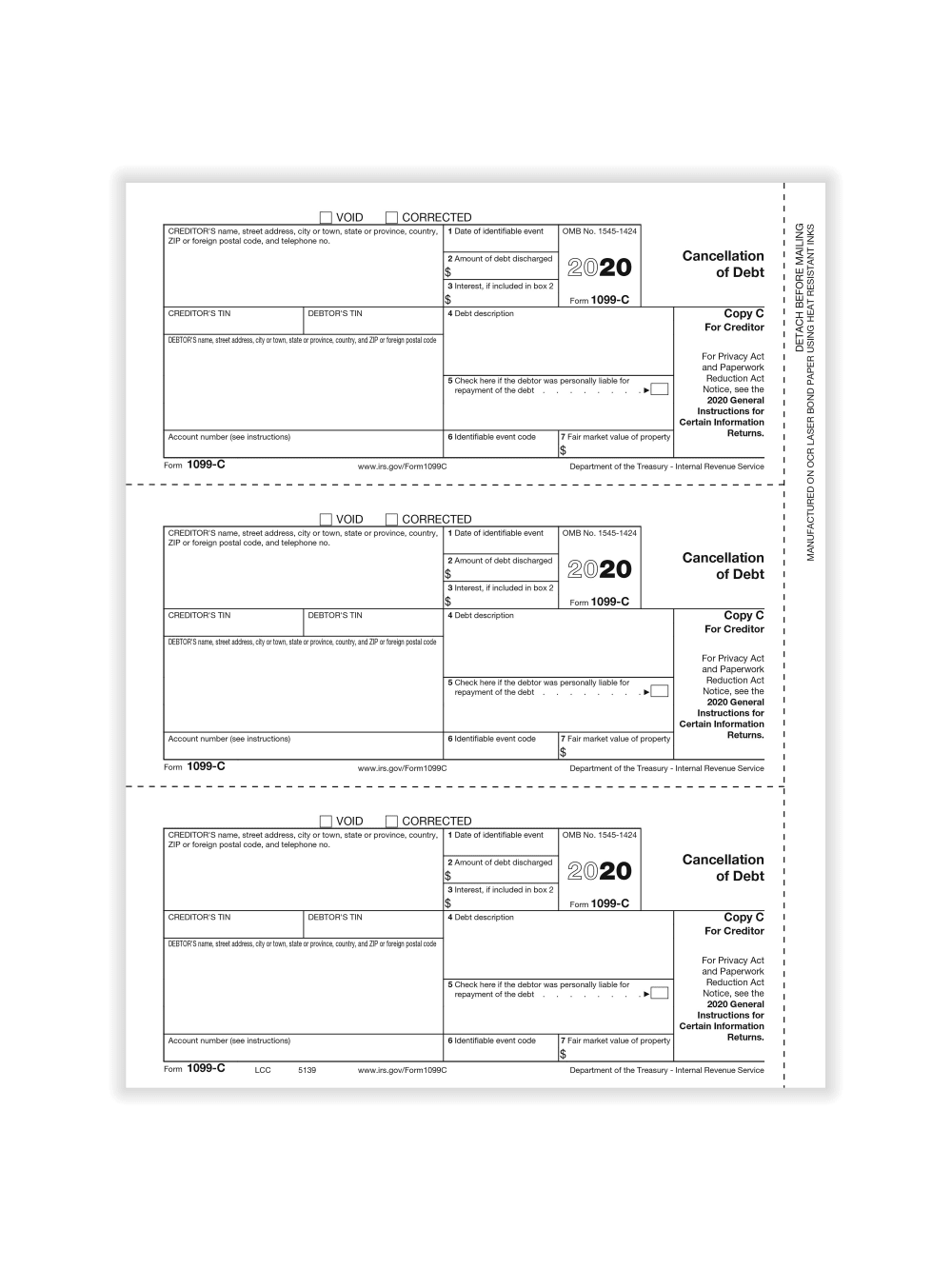

2020 form 1099-c cancellation of debt

2020 form 1099-c cancellation of debt-Select the type of canceled debt (main home or other) and then select Continue; IRS 1099C Form 1099C Form IRS 1099C Instructions 1099C Instructions No labels Overview Content Tools Powered by Atlassian Confluence 760;

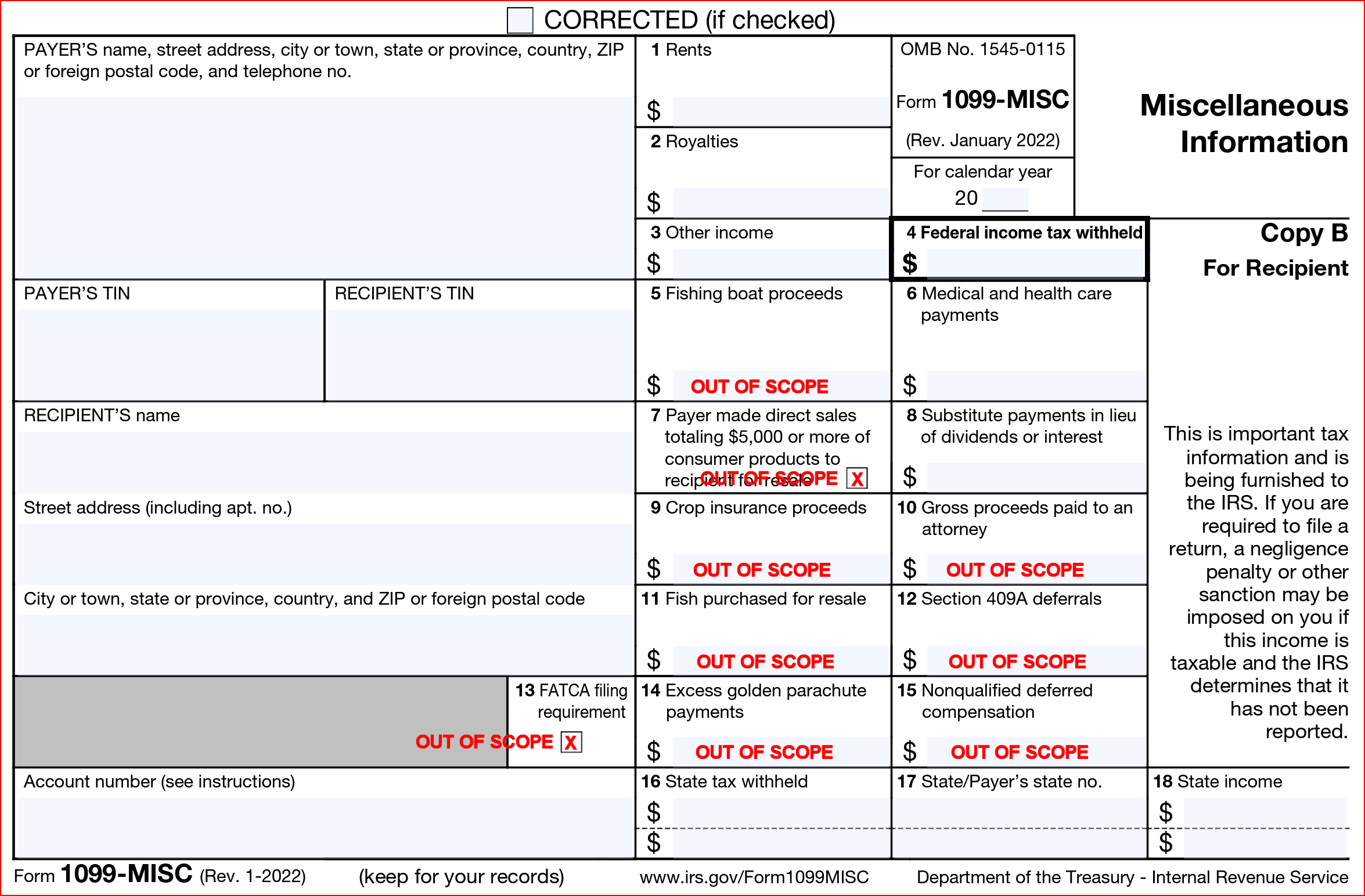

1099 Misc Form Fillable Printable Download Free Instructions

Q Does the 1099C form mean my debt is canceled and can no longer be collected upon? 1099NEC Snap and Autofill Available in TurboTax SelfEmployed and TurboTax Live SelfEmployed starting Available in mobile app only Feature available within Schedule C tax form for TurboTax filers with 1099NEC new forms for If you have used 1099MISC to report nonemployee compensation in Box 7, you MUST CHANGE to 1099NEC forms in Use the new 1099NEC

Form 1099C is a tax form required by the IRS in certain situations where your debts have been forgiven or canceled The IRS requires a 1099C form for certain acts of debt forgiveness because it considers that forgiven debt as a formUnlimited updates and copies, for free Hundreds of other legal documents Export toAd1) Fill Out A 1099MISC Form With Our Easy Guide 2) File Online & Print Free!

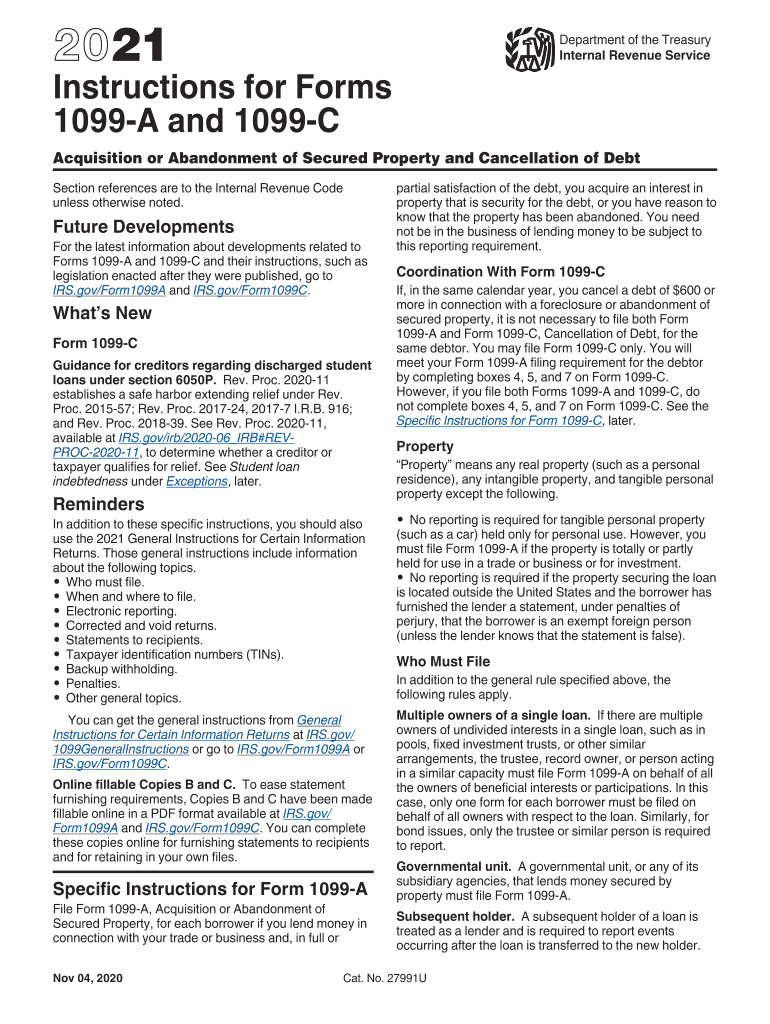

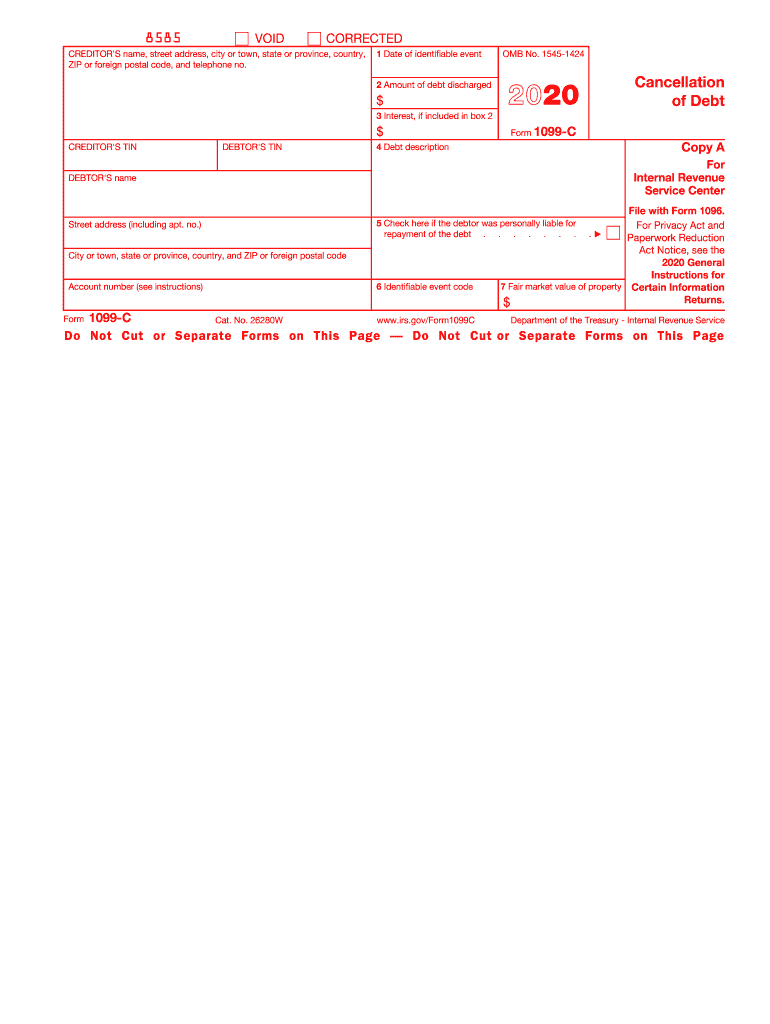

On the screen titled Cancellation of Debt Form 1099C Information, enter the information from Form 1099A as follows Enter Box 1 (1099A) in Box 1 (1099C) Generally, enter Box 2 (1099A) in Box 2 (1099C) However, if the amount of debt canceled is different from the amount reported in Box 2 of your 1099A, enter the amount of debt actually canceled Your lender can tell you this amount Enter any accrued interest that was canceled in Box 3 (1099C)Complete IRS 1099C 21 online with US Legal Forms Easily fill out PDF blank, edit, and sign them Save or instantly send your ready documentsWithin a 1040 return, there is not a specific IRS 1099C input form to fill in Instead, depending how the cancellation of debt is to be treated, there are a few options you have in order to get this to flow correctly to your return Method 1 To have the amounts from the IRS 1099C

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

What Do I Do With This Irs Cp00 Claim I Owe Tax On A Cancelled Debt Wake Forest News

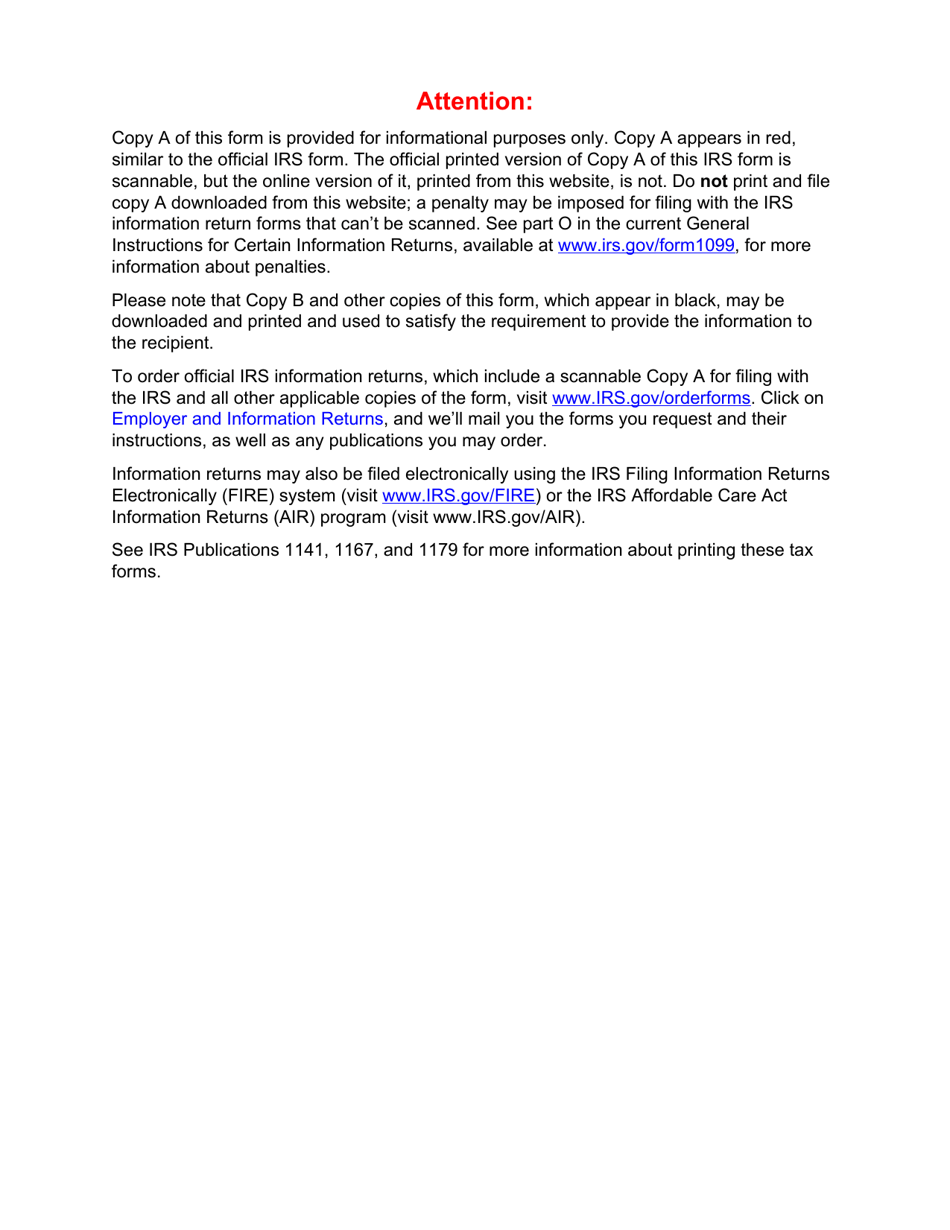

Fileid s/I1099A&C//A/XML/Cycle05/source 1056 3Mar The type and rule above prints on all proofs including departmental reproduction proofs MUST be removed before printing File Form 1099C,Form 1099C 21 Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS IfForm 1099C Cancellation of Debt (Info Copy Only) 21 Form 1099C Cancellation of Debt (Info Copy Only) 19 Form 1099CAP Changes in Corporate Control and Capital Structure (Info Copy Only) 0919 Form 1099

When To Expect Your W 2 1099 In What To Do If They Re Missing Taxgirl

What Is Form 1099 Nec Who Uses It What To Include More

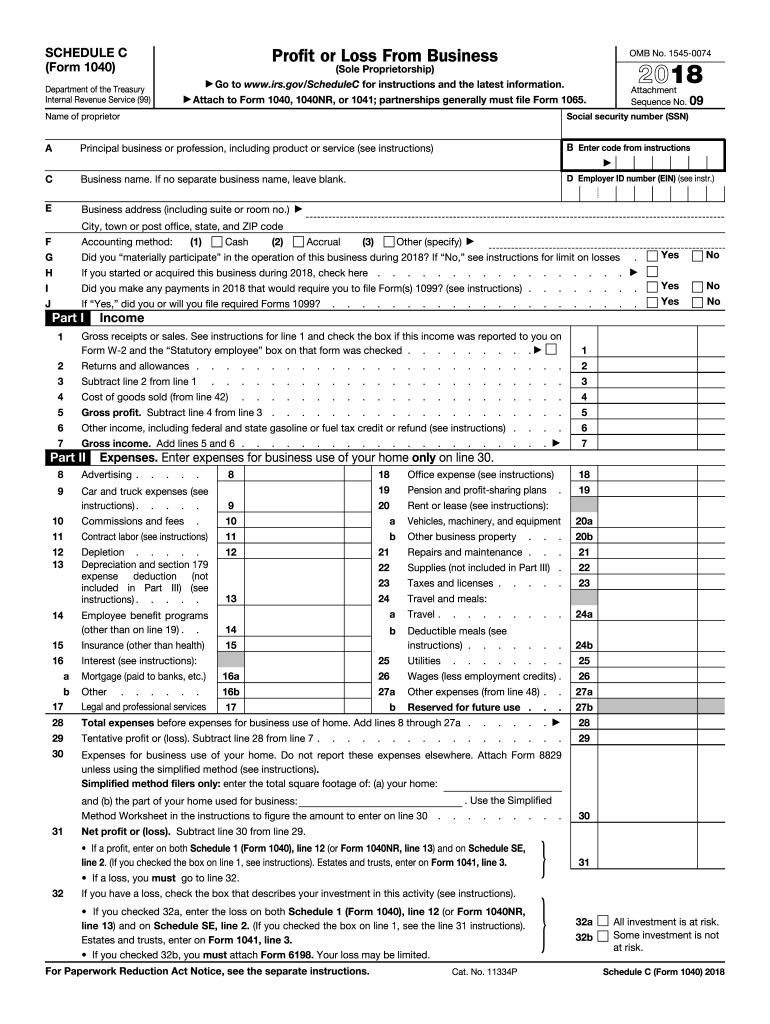

Form 1099C is used by lenders whom you canceled $600 or more of a debt owed to you in the same calendar year as 1099A You do not need to file both a 1099A and 1099C Fill out boxes 4, 5, and 7 on the 1099A to meet your filing requirements However, if you do file both a 1099A and 1099C, do not fill out boxes 4, 5, and 7 on Form 1099C Reporting 1099C Income If you get a 1099C for a personal debt, you must enter the total on Line 21 of Form 1040 personal income tax If it's a business or farm debt, use a Schedule CForm 1099 C Cancellation Of Debt Fill Out and Sign Printable PDF Template signNow

Irs Form 1099 C And Canceled Debt Credit Karma Tax

3

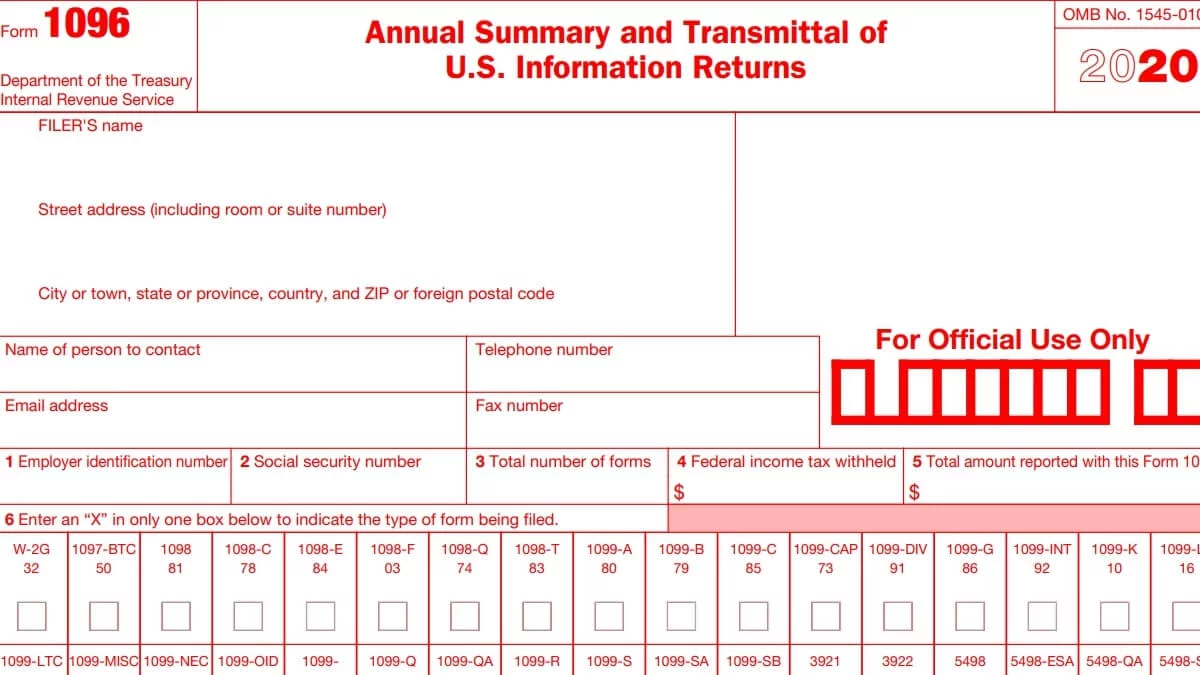

60,708,852 Documents Made Highly Professional Avoid Form Errors Edit Online InstantlyConsolidated Form 1099 There have been no significant relevant changes or enhancements to Forms 1099 for the tax year 5 of 37 Delayed reporting message The Consolidated Form 10992) Sign & Print Instantly Start Now Until 8/15

1099 C Form 21 1099 Forms Zrivo

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Click Other Income in the Federal Quick Q&A Topics menu to expand, then click Cancellation of Debt (Form 1099C)A 1099C is a form used to report various types of income It's one of several 1099 forms that are used to report income that isn't reported on W2 formsFile 1099C Online with Tax1099 for easy and secure eFile 1099C form How to file 1099C instructions & due date IRS authorized eFile service provider for form 1099C

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

1099 C Cancellation Of Debt H R Block

To enter or review the information from Form 1099C Cancellation of Debt into the TaxAct ® program From within your TaxAct return (Online or Desktop), click FederalOn smaller devices, click in the upper lefthand corner, then click Federal;AdDownload or Email Form 1099C & More Fillable Forms, Register and Subscribe Now! Nicole Dieker 12/1/ You might also receive a 1099C form for a debt that was forgiven, but the creditor listed the wrong amount of canceled debt on the form

1099 C Tax Form Copy B Laser W 2taxforms Com

1099 C Tax Form Copy A Laser W 2taxforms Com

Form 1099MISC Miscellaneous Income (Info Copy Only) 21 Form 1099MISC Miscellaneous Income (Info Copy Only) Inst 1099MISC Instructions for Form 1099MISC, Miscellaneous Income Inst 1099About Form 1099C, Cancellation of Debt Internal — Information about Form 1099C, Cancellation of Debt (Info Copy Only) Learn more Form 1099C IRS Courseware Link & Learn Taxes Lenders or creditors are required to issue Form 1099C,Create 1099C Form in less than 5 minutes Professionally reviewed Print and export

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Nec Form Copy C 2 Zbp Forms

If a Form 1099C Cancellation of Debt for canceled debt is issued to an S Corporation, the income inclusion (or exclusion) is applied at the corporate level If applicable, the corporation would then file FormCancellation of Debt (Info Copy Only) Form 1099C 8585 VOID CORRECTED CREDITOR'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no 1 Date of identifiable event 2 Amount of debt discharged $ 3 Interest, if included in box 2 $ CREDITOR'S TIN DEBTOR'S TIN OMB No Form 1099CInst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099B Instructions for Form 1099

1099 Nec Laser Forms 5 Part Kit With Envelopes Plus Online Form Filler

1099 Misc Tax Form 4 Part Kit For 25 Employees With Self Seal Envelopes Designed For Quickbooks And Accounting Software Forms Recordkeeping Money Handling Office Supplies Signtech Com Vn

You don't have to report anything on your tax return until you receive form 1099CAnd it depends on the lender when they will issue the form The debt is considered cancelled once your lender/creditor no longer expects for that money to come and they close their books It may be a couple years before they decide to foreclose and cancel your debt and issue you the 1099C formEfile Form 1099C Online to report the Cancellation of debt Efile as low as $050/Form IRS Approved We mail the 1099C copies to your debtorThe sigNow extension was developed to help busy people like you to decrease the burden of putting your signature on forms Begin esigning form 1099 c cancellation of debt by

Form 1099 Misc To Report Miscellaneous Income

Office Depot

Link to comment 1099 cPreparing yearend forms has never been easier!Ad1) Fill Out A 1099MISC Form With Our Easy Guide 2) File Online & Print Free!

1099 C Cancellation Of Debt A Complete Guide To The 1099 C Credit Com

1099 Misc Form Copy C 2 Recipient State Zbp Forms

Get a 1099C () here Edit Online Instantly!The W2/1099 Forms Filer prepares W2s, all 1099s and many other forms for yearend payroll processing For and later, the forms filer Beginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099NEC instead of on Form 1099MISC Businesses will need to use this form

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

Form 1099 C And How To Avoid Taxes On Cancelled Debt Etax Com Blog

If you received both a Form 1099A Acquisition or Abandonment of Secured Property and a Form 1099C Cancellation of Debt for a rental property, enter the Form 1099C first to determine if the canceled debt is taxable If it is, you must decide whether or not to file Form Posted Can't find a form to download for a 10c Cancellation of debt Does one exist under a different name or am I putting it on line 8, Sch 1 other income and entering it myself? Information about Form 1099C, Cancellation of Debt (Info Copy Only), including recent updates, related forms, and instructions on how to file File 1099C for canceled debt of

Www Idmsinc Com Pdf 1099 Nec Pdf

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

60,708,852 Documents Made Highly Professional Avoid Form Errors Edit Online InstantlyUnlimited updates and copies, for free Hundreds of other legal documents Export to I'm doing my 19 taxes not I was able to select the Jump to link to download the 1099C I answered the the following questions On the Tell us about your canceled debt screen, select Yes;

Irs Instruction 1099 A 1099 C 21 Fill Out Tax Template Online Us Legal Forms

3

Ad1) Create 1099MISC Online!Receiving a 1099C should always mean the debt is canceled and no longer subject to collection But it may be up to you to make sure Until 16, IRS rules allowed creditors to file a 1099CForm 1099NEC as nonemployee compensation Any amount included in box 12 that is currently taxable is also included in this box This income is also subject to a substantial additional tax to be reported on Form 1040, 1040SR, or 1040NR See the Instructions for Forms 1040 and 1040SR, or the Instructions for Form

1099 Nec Form Copy C 2 Payer Discount Tax Forms

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

NEW 1099NEC Forms replace 1099MISC for nonemployee compensation reporting in NEW 1099NEC is used for payments of $600 or more to nonemployees, such as contractors, freelancers, some attorney payments and more Learn about new 1099NEC Forms NEW EFILING REQUIREMENTS If a payer has 100 forms to file, they MUST EFILE Copy A in ! Form MA 1099HC Individual Mandate Massachusetts Health Care Coverage Massachusetts Department of Reve nue 1 Name of insurance company or administrator 2 FIDHowever, it did not take me to where I need to enter the information from the 1099C

1099 Misc Form Copy B Recipient Zbp Forms

5 Part 1099 Misc Tax Forms 8 5 X 11 50 Pack Court Street Office Supplies Inc

A 1099C reports Cancellation of Debt Income (CODI) A lender is supposed to file a 1099C form if it "cancels" $600 or more in debt Ask for a corrected 1099C form New for the tax year Thanks to the federal government's Consolidated Appropriations Act, which was signed into law on Dec 27, , taxpayers who've had mortgage debt forgiven might not have to pay taxes on it when filling out their A 1099C is a tax form that the IRS requires lenders use to report "cancellation of indebtedness income" This form must be filed in certain circumstances where more than $600 in debt is cancelled, or goes unpaid for a certain period of time The lender files this form

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

1099 Nec Form Copy B C 2 Recipient Payer Discount Tax Forms

If you had any debts canceled or expect to receive a 1099C, you may want to work with a professional tax service to file your taxes What Is a 1099C Cancellation of Debt?Ad1) Fill Out 1099C IRS Forms In Your Browser 2) File Online & Print 100% Free!

:max_bytes(150000):strip_icc()/Screenshot97-2634390b2e984de3b6aecbab43ad252d.png)

Irs Form 1099 K What Is It

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Www Irs Gov Pub Irs Pdf P12 Pdf

1099 C Discharge Without Debt Cancellation Not Consumer Protection Law Violation Mcglinchey Stafford Jdsupra

1096 Form 21 1099 Forms Zrivo

Forms 1099 A And 1099 C Which Form To File For Loan Transactions

Amazon Com Laser 1099 Misc Tax Forms Copy A B C C 2 Moisture Seal Envelopes 5pt Set 100 Pk Office Products

1

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Ok Form 501 21 Fill Out Tax Template Online Us Legal Forms

What Is An Irs Schedule C Form And What You Need To Know About It

Irs Releases Draft Form 1040 Here S What S New For

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1095 C Faqs Mass Gov

Complyright Taxright 1099 Misc 4 Part Laser Tax Form Kit With Envelopes Sc6103e10 Walmart Com Walmart Com

What Is A 1099 C Cancellation Of Debt Form Bankrate

What Is Form 1099 Nec Nonemployee Compensation

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Changes To 1099s In Altruic Advisors

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What Is Form 1099 Nec Nonemployee Compensation

Office Irs Tax Form 1099 Misc Carbonless For 24 Recipients No Env 3 1096 Office Supplies

1099 Misc Form Fillable Printable Download Free Instructions

Index Of Forms

1099 C Surprise Canceled Debt Often Taxable As Income Creditcards Com

Irs Announces Form 1099 C Not Required For Ppp Loan Forgiveness Mcglinchey Stafford Pllc

What Your Co Op Needs To Know About 1099 Filing

What Is A 1099 C Cancellation Of Debt Form Bankrate

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

Amazon Com Tops 1099 Nec Forms 5 Part 1099 Forms Laser Inkjet Tax Form Sets For 50 Recipients Includes 3 1096 Forms 50 Pack Tx Nec Office Products

Form 1099 Changes For Tax Year Lioness Magazine

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

1099 C Carbonless 4 Part W 2taxforms Com

Major Changes To File Form 1099 Misc Box 7 In

1099 C Cancellation Of Debt Will You Owe Taxes Credit Com

1099 Misc Form Fillable Printable Download Free Instructions

Debt Forgiveness The Pros And Cons Lexington Law

:max_bytes(150000):strip_icc()/ScreenShot2021-06-03at10.46.06AM-94eb26d209884e0e9190a59995dbee63.png)

What Is Irs Form 1099 C

What You Need To Know About Instacart 1099 Taxes

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099 Oid Original Issue Discount Definition

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

1099 Nec Form Copy B C 2 3up Zbp Forms

Communications Fidelity Com Sps Library Docs Bro Tax Espp Click Pdf

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

Schedule C Form Fill Out And Sign Printable Pdf Template Signnow

New Form 1099 Reporting Requirements For Atkg Llp

1096 Form 1099 Forms Taxuni

What Is A 1099 Form H R Block

Form Irs 1099 C Fill Online Printable Fillable Blank Pdffiller

What Is A 1099 Tax Form Guide To Irs Form 1099 Mintlife Blog

Instant Form 1099 Generator Create 1099 Easily Form Pros

How To Fill Out And Print 1099 Nec Forms

Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Calameo Irs Instructions For 1099a C

What Is Form 1099 Nec For Nonemployee Compensation

Irs Form 1099 Nec And 1099 Misc Rules And Exceptions

1099 Misc Form Fillable Printable Download Free Instructions

1040 Schedule C Form Fill Out Irs Schedule C Tax Form

:max_bytes(150000):strip_icc()/Screenshot31-f811e886d8fd4dc183e95ee360004fb3.png)

Irs Form 1099 A What Is It

Index Of Forms

/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png)

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Understanding Your Form 1099 R Msrb Mass Gov

I Just Got A 1099 C Form For A Debt From 16 Years Ago

Understanding A 1099 C For Your Student Loan Debt

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

How To Read Your 1099 Robinhood

Irs Form 9 Is Your Friend If You Got A 1099 C

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

0 件のコメント:

コメントを投稿